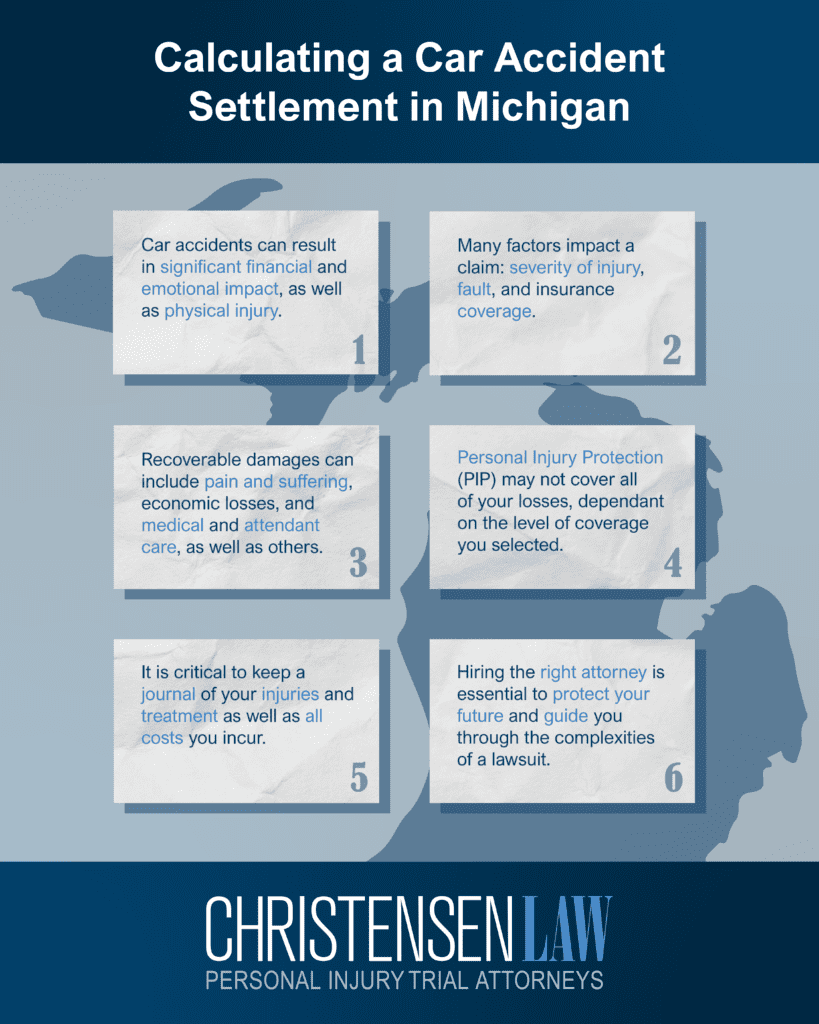

If you or a loved one has been injured in an accident in Michigan, you may find it difficult to get the compensation you need and deserve. At-fault drivers and their insurance companies do not always want to admit fault and make a fair offer. When you’re fighting for your future, having dedicated and experienced Michigan car accident lawyers on your side can level the playing field.

A Michigan personal injury attorney from Christensen Law will fight to secure the financial compensation you need for your recovery. During our first meeting, you can discuss the details of your car accident claim with one of our auto accident injury lawyers. You can also learn more about your legal rights and the monetary compensation you may be entitled to. Call our team to get started.

How Our Michigan Car Accident Lawyers Can Help You with Your Claim

When you’ve been in an auto collision, you do not have to try to get compensation for your injuries and damages on your own. Instead, turn to a car accident attorney from Christensen Law. We can help you pursue your car accident injury claim by:

- Investigating your accident to secure the evidence you may need to build your legal case.

- Consulting with expert witnesses to develop persuasive legal arguments.

- Identifying who was at fault for your accident.

- Helping you understand the claim process and advise you on the best steps to take in your case.

- Contacting insurance companies and filing claims for compensation.

- Negotiating with insurance adjusters and defense lawyers to reach a settlement with full and fair compensation for you.

If we can’t reach a fair settlement in negotiations, we will also prepare your case for trial if necessary. We aren’t afraid to take your car accident case to court and argue for the compensation you need and deserve.

Don’t let insurance companies pressure you into accepting a low settlement—a car accident attorney from our Michigan firm on your side will ensure that you seek the full and fair compensation you are entitled to for your injuries and other losses.

Contact Christensen Law today for a free consultation with one of our personal injury lawyers. We are ready to fight for your rights and guide you through every step of the claim process. Let us take the burden off your shoulders so you can focus on healing and recovery while we handle the legal complexities of your Michigan car accident claim.

Our Car Accident Lawyers at Christensen Law Get Results

At Christensen Law, we focus on getting justice rather than settling for less. We put your needs first to ensure you get the compensation you need after a vehicular accident.

Our team of car accident attorneys has a proven track record of successfully handling complex cases and securing significant settlements and verdicts for our clients. Here are just some of our results:

- $4.197 million for a passenger in a car accident

- $3.2 million for the severe injuries of one driver and the death of his wife

- $2 million for a construction worker who was left with a brain injury after a rear-end car accident

We make sure to account for the physical, emotional, and financial toll that a car accident can take on victims and their families. Our team is dedicated to providing personalized, compassionate representation that addresses your unique needs and goals.

With our extensive knowledge of Michigan’s No-Fault insurance laws and our commitment to aggressive advocacy, our car accident lawyers in Michigan can help you navigate the legal process and fight for the maximum compensation you deserve.

Compensation Our Car Accident Lawyers Can Get for Your Michigan Claim

If you’ve been involved in a Michigan car accident that was another driver’s fault, you may be entitled to compensation for the damages you have experienced because of the accident. Our car crash lawyers will fight to obtain you damages like:

- Medical treatment like hospital stays, surgeries, doctor’s office visits, prescriptions, rehabilitation services, and mobility and medical equipment.

- Long-term care costs, such as personal care costs or alterations to your home to accommodate disabilities caused by your injuries.

- Lost wages and income, if you miss time from work while recovering from your accident.

- Future lost earnings if your injuries prevent you from earning the same level of pre-accident income.

- Pain and suffering, or the physical and mental anguish caused by your injuries.

- Lost quality or enjoyment of life due to physical disfigurement or disabilities.

An auto accident attorney with our team will be able to review the details of your case to determine how much compensation you may be owed.

How Negligence Leads to Car Accident Claims in Michigan

There are many ways car accidents happen in Michigan, but most are caused by driver negligence. In other words, if only drivers were more careful on our roads, many of the state’s accidents could be avoided. This can be especially frustrating if you’ve been hurt in a wreck.

Common negligence-based reasons for Michigan’s car accidents include:

- Speeding

- Failing to yield

- Running a stop sign or red light or other traffic control

- Improper passing

- Unsafe turning, including failing to use turn signals, check mirrors or yield to traffic

- Unsafe lane changes, including failing to signal or check mirrors and blind spots

- Following too closely (tailgating)

- Reckless driving, such as driving excessively fast or swerving through heavy traffic

- Inexperienced drivers

- Drowsy or fatigued drivers

- Driving under the influence of alcohol or drugs

- Poor road conditions, such as potholes or snow and ice

- Bad weather, such as snow, heavy rain or fog

- Vehicle defects

- Distracted drivers

Filing a car accident claim and demanding compensation from negligent drivers can hold them accountable and force them to do better in the future. As an injured driver, passenger, or pedestrian, it is your legal right to file a claim in Michigan if you were hurt and you weren’t at fault

Common Injuries Attorneys Can Seek Compensation for in a Michigan Auto Claim

Victims of car accidents can suffer a wide variety of injuries, many of them catastrophic. Common injuries that car accident victims suffer that form the basis of Michigan car accident claims include:

- Severe contusions and lacerations, which can lead to dangerous bleeding

- Broken bones

- Sprains and tears of soft tissues like muscles, tendons, and ligaments

- Neck and back injuries, such as disc herniations or ruptures

- Organ damage and internal bleeding

- Spinal cord injuries and paralysis

- Amputations

- Burns

- Head injuries, including eye and ear trauma

- Traumatic brain injuries

In general, the more serious your injuries, the higher your compensation will be. This is because car accident victims with catastrophic, life-changing injuries may require a lifetime of medical care, help with everyday tasks, adaptive equipment, and other expenses related to the injuries they sustained in the wreck.

A Michigan car crash lawyer can evaluate the specifics of your case to determine the compensation you may be entitled to receive for such injuries. Please contact us today!

Types of Accidents Our Car Accident Attorneys Handle Across The Great Lakes State

Our auto accident lawyers have extensive experience managing a wide range of Michigan accident cases, ensuring that every client receives skilled legal guidance tailored to their unique situation. Some of the cases our law firm represents include (but are not limited to) the following:

- Rear-end collisions: Common but serious, often resulting in whiplash or spinal injuries.

- T-bone accidents: Side-impact crashes that can lead to severe injuries for passengers.

- Head-on collisions: Among the most dangerous, often causing life-altering injuries.

- Multi-vehicle pileups: Complex cases requiring thorough investigation and legal expertise.

- Hit-and-run accidents: Our car accident lawyers can help victims pursue justice even when the at-fault driver flees.

- Rollover crashes: Often linked to SUVs or high-speed accidents, resulting in serious harm.

- Drunk driving accidents: Our car crash attorneys can hold impaired drivers accountable for the devastation they cause.

- Distracted driving accidents: Including texting, phone use, or other negligent behaviors.

No matter where you are in Michigan, we are committed to standing by your side. We’ll work tirelessly to help you recover the financial compensation needed to rebuild your life after a car accident.

Time Limit for Filing a Car Accident Lawsuit in Michigan

If you’ve been involved in a car accident in Michigan, time is of the essence. Taking immediate action can greatly impact the success of your case. When you’ve been injured and suffered damages, you have a time limit on filing a personal injury lawsuit. In Michigan, the time limit on car accident lawsuits is generally three years from the date of your accident per Mich. Comp. Laws Ann. § 600.5805.

The time limit on filing a lawsuit may be extended in certain circumstances. For instance, the time limit can be extended for minors or for accidents with hit-and-run drivers who victims could not immediately identify.

If you don’t file your lawsuit before Michigan’s statute of limitations expires, the court may permanently dismiss your lawsuit. If that happens, you will lose your right to seek compensation for your accident. To protect your right to compensation, be sure to contact a Michigan car crash lawyer for a free case review as soon as you’re ready to learn more about your legal options.

Get in Touch with a Christensen Law Michigan Car Accident Lawyer Today

At Christensen Law, our dedicated auto accident legal team is ready to review your case, understand your unique circumstances, and outline the best path forward. We operate on a contingency fee basis in all our Michigan offices, meaning you won’t pay a dime until we secure compensation for you.

To learn more about how we can assist you and your family, contact our office to schedule your free consultation today. A Michigan car accident lawyer from our team is ready to fight for you.